Oct. 23 (Bloomberg) -- India’s stocks rose for the first time in four days, led by Dr. Reddy’s Laboratories Ltd. and ITC Ltd. after earnings beat estimates. Reliance Industries Ltd. fell as a partner said it will abandon an exploration project.

Dr. Reddy’s, the third-biggest drugmaker by market value, advanced the most in a month, while ITC, the nation’s largest tobacco company, climbed to a record. Reliance, the nation’s most valuable company, sank to a six-week low as its U.K.-based partner announced it will abandon a well off India’s east coast that showed “poor” reservoir sands.

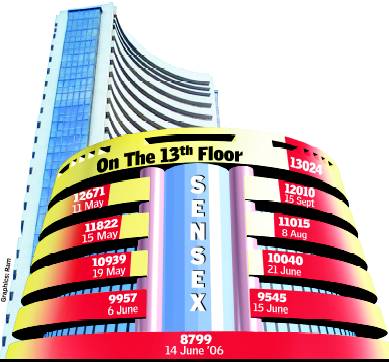

The Bombay Stock Exchange’s Sensitive Index, or Sensex, added 21.07, or 0.1 percent, to 16,810.81. The advance pared this week’s decline to 3 percent, the biggest drop in almost three months. The S&P CNX Nifty Index on the National Stock Exchange rose 0.2 percent to 4,997.05. The BSE 200 Index increased 0.3 percent to 2,089.52.

“All indicators are in favor of Indian equities,” said Apurva Shah, head of research at Prabhudas Liladher Pvt. in Mumbai, who has a 12-month target of 19,000 for the Sensex. “The dollar continues to slide, which is sending more liquidity to emerging markets like India and even earnings are turning out to be alright.”

Dr. Reddy’s

Dr. Reddy’s rose 6.3 percent to 959.6 rupees after it said second-quarter profit more than doubled as sales in the U.S. and Russia gained and as currency fluctuations worked in the company’s favor. Net income climbed to 2.17 billion rupees ($47 million) in the three months ended Sept. 30, beating the 1.97 billion-rupee median of 14 analyst estimates compiled by Bloomberg in the past four weeks.

ITC climbed 5 percent to 260.2 rupees. Its second-quarter net income rose to 10.1 billion rupees in the three months ended Sept. 30 from 8.03 billion rupees a year earlier, beating the 9.24 billion rupee median estimate of 20 analysts surveyed by Bloomberg.

Asian Paints Ltd., the largest paint-maker, soared 9.7 percent to 1,678 rupees after its net income doubled to 2.68 billion rupees in the three months ended Sept. 30.

Reliance fell 4.1 percent to 2,047.35 rupees. The company and its partner, Hardy Oil & Gas PlcHardy Oil, the Douglas, Isle of Man-based explorer, will plug and abandon the KGD-A1 well, the first of a four-well program at Block D9 in the Krishna Godavari basin. Hardy holds a 10 percent of the block, while Reliance owns the rest and is the operator.

‘Bursts That Expectation’

“Investors were expecting big gas reserves in the D9 area after earlier announcements,” said Deepak Pareek, a Mumbai- based analyst with Angel Broking Ltd. “This news bursts that expectation.”

Sterlite Industries (India) Ltd., the nation’s biggest copper producer, gained 1.7 percent to 829 rupees. Hindalco Industries Ltd., the biggest aluminum producer, added 2.5 percent to 141.45 rupees.

Copper for three-month delivery added $79.75, or 1.2 percent, to $6,669.75 a ton on the London Metal Exchange. Aluminum rose 1.1 percent to $1,987 a ton after advancing as high as $2,000, the highest intraday price since Aug. 19.

Overseas funds sold a net 3.92 billion rupees of Indian stocks on Oct. 21, the Securities and Exchange Board of India said on its Web site. The funds have bought 681 billion rupees of Indian stocks this year to date, compared with record net sales of 530 billion rupees for the whole of 2008.

0 comments:

Post a Comment